Business Expansion

Distribution Module

TLDR:

What are smallcases and what is this project about?

One of the most fundamental principles of sound investing is diversification. Portfolio investment thus becomes the most logical approach for greater returns with minimum risks. And while there are options to invest in diversified portfolios (for eg. through Mutual Funds or PMS), investors are increasingly looking to invest in direct equity that they have more control over. This is where smallcase comes into the picture with 100% transparent constituents, that are held in the user’s demat account. This in turn gives the users not just the expert intervention they look for, but also a sense of control over their investments.

Advisors are thus accommodating for this user preference to invest in direct equity by distributing smallcase portfolios designed basis a strategy, theme, goal that suit the user’s risk profile. However, building an entire module journey on their platform, to enable smallcase investment with discovery, transaction and tracking, is an extensive project that demands high levels of product, design as well as tech efforts on the partner’s end.

Enter Distribution Module! ⭐️

smallcase now offers a plug and play solution for the discovery, transaction and tracking of expert-made portfolios, that can be accessed by the partner app users, natively.

What do partners get out of it?

🔎 Minimal effort to enable portfolio investment on their platform. smallcase Gateway team takes care of the entire integration process which includes discovery, transaction and tracking of these portfolios

🤝 Added value for their users by allowing direct equity investment that comes with expert guidance

🪪 Expert management of these portfolios by SEBI-licensed brokers, advisors and analysts

What do their users get out of it?

Expert managed direct equity investment

Ability to invest in baskets of stocks and ETFs, that they can discover, transact in and track, all at one place

The Design Process

As a designer, I'm a strong advocate of 'actual user needs being the best leverage for business metrics'. Hence, our Distribution Module is designed to cater to the end user needs as priority. Here is a detailed design case study that will take you through the different product and design stages & decisions taken for crafting the best solutions for the end users.

Other than establishing DM as a useful tool for our partners, we wanted to understand our end users that we need to design for.

We started by hypothesizing the user problems to shape our thoughts:

Investors want to diversify their portfolios but find it difficult to invest in portfolios of stocks and ETFs by themselves, with little to no capital knowledge.

It is also cumbersome for investors to place individual orders for all stocks in the baskets, and track it separately by entering each trade in portfolio tracking apps.

Some partner apps may also have pre-investors that don’t invest yet, but are looking for a suitable instrument and expert guidance to get started with.

Now that we had some foresight on the user problems, our next step was to list down the objectives through DM.

Objectives:

Increase adoption and transactions of smallcases

Make smallcase the go-to option for beginners looking for expert guidance on portfolio investment.

To validate these user needs and objectives, our next steps were to dive into user research that would give us more refined context on the user problems and goals.

Assumptions about our users:

Having already registered on finance management apps, we can assume the following for our users at this stage:

These users are more inclined to organising their finances.

They may or may not be investors already, but they maybe open to investing in stocks.

They are looking for opportunities to better manage/ invest their funds that will give them good returns.

The userbase will include both, those well versed with the markets and those not.

Demographics:

65-70% of our target users are millennials i.e age 18-35. (derived from a recent study conducted by ET Money)

No hard statistics to support this claim, but about 99% of investors are estimated to be passive investors. (source)

User personas include:

Pre investors: Don’t invest yet

Passive Investors: Invest with minimal intervention themselves.

Active Investors: Active participation, those who create their own smallcases

Based on the above, we sketched out some user personas that would constitute our target users.

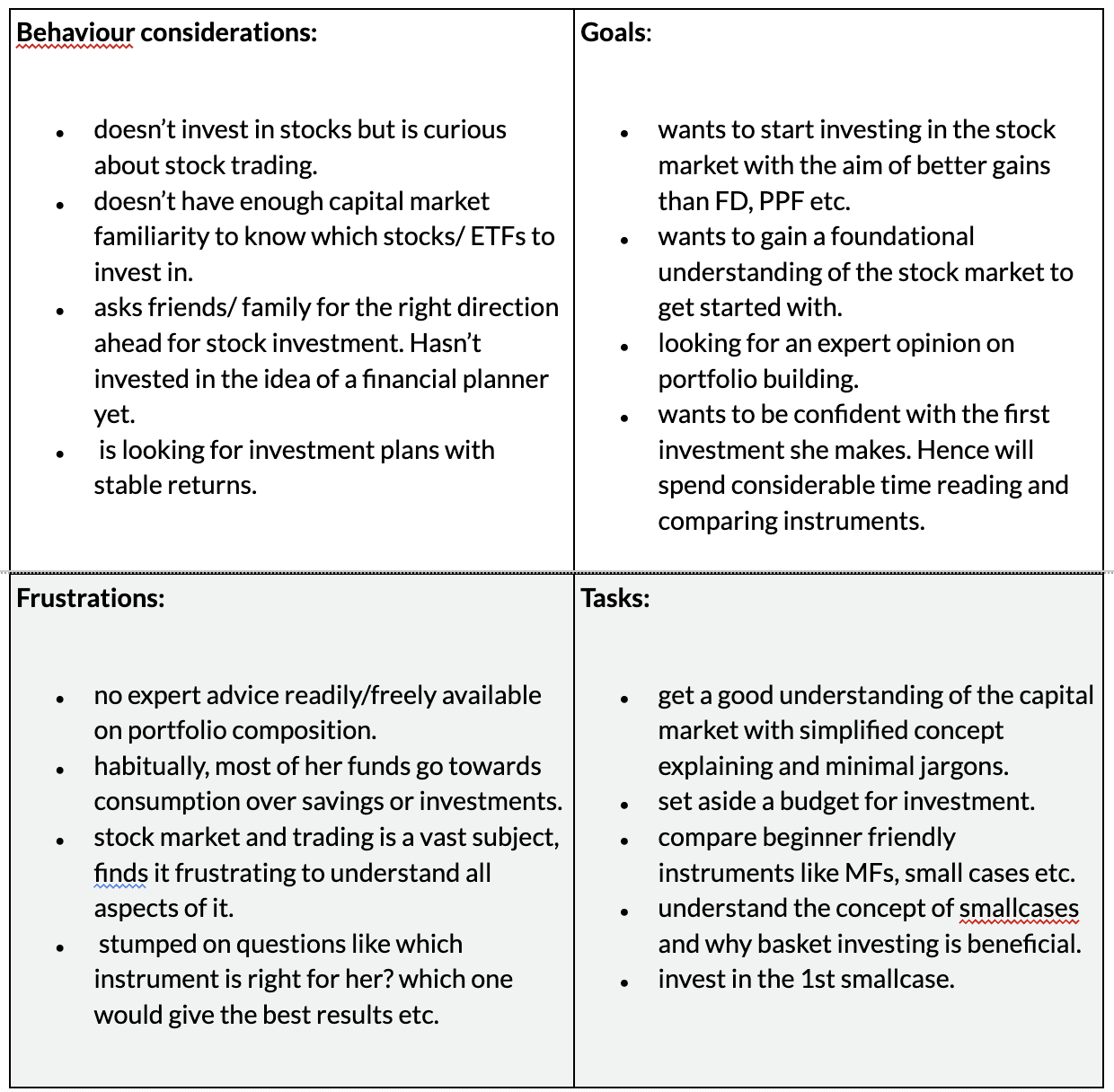

Pre Investor: Rhea

Rhea is a 25 year old who is not an investor currently, but is financially sound and organised. She earns enough to be able to start investing in the capital market.

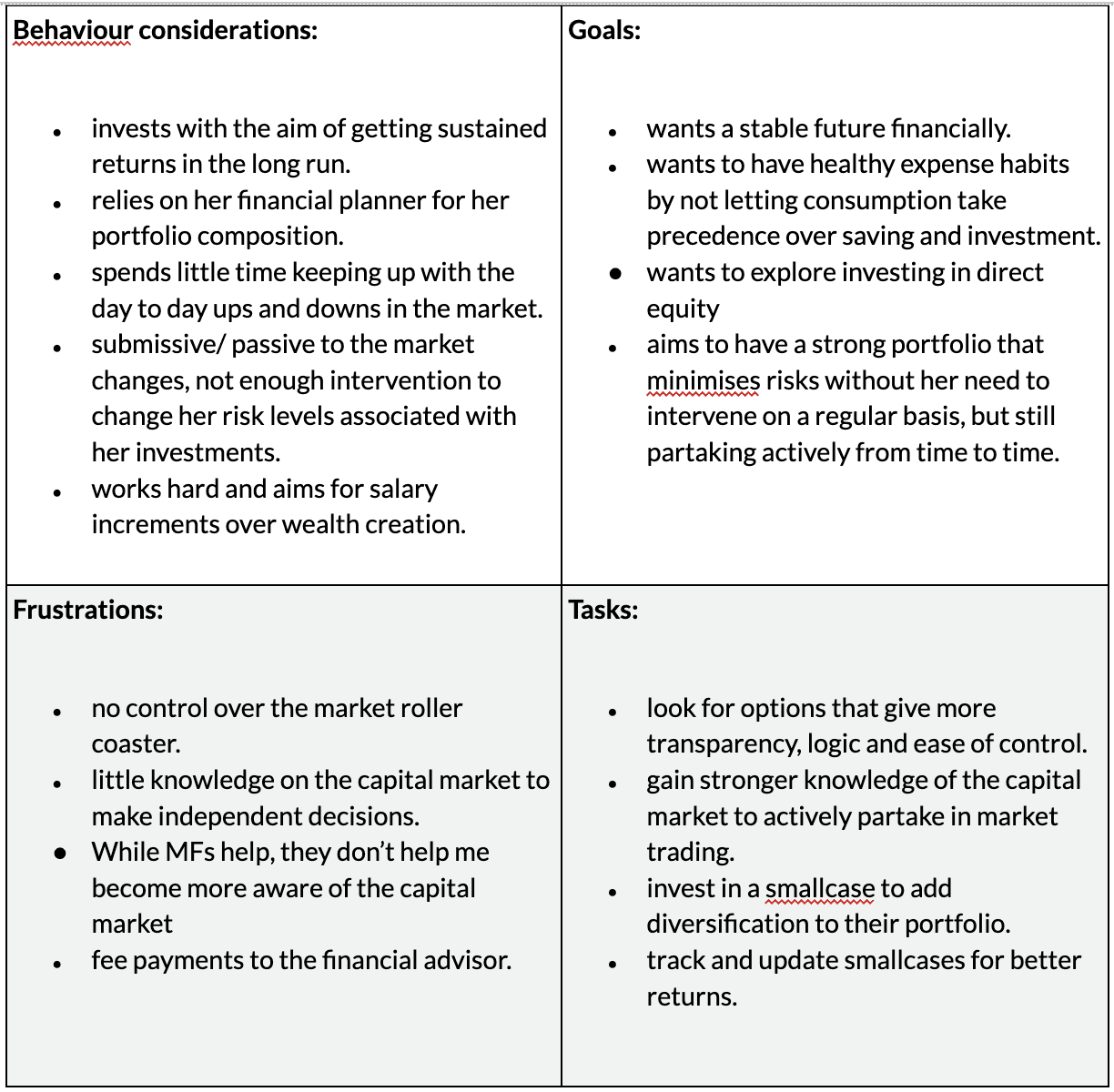

Passive Investor: Purvi

Purvi is a 34 year old who leads a busy professional lifestyle but invests a certain % of her earnings in the capital market. She likes to plan ahead for a stable future.

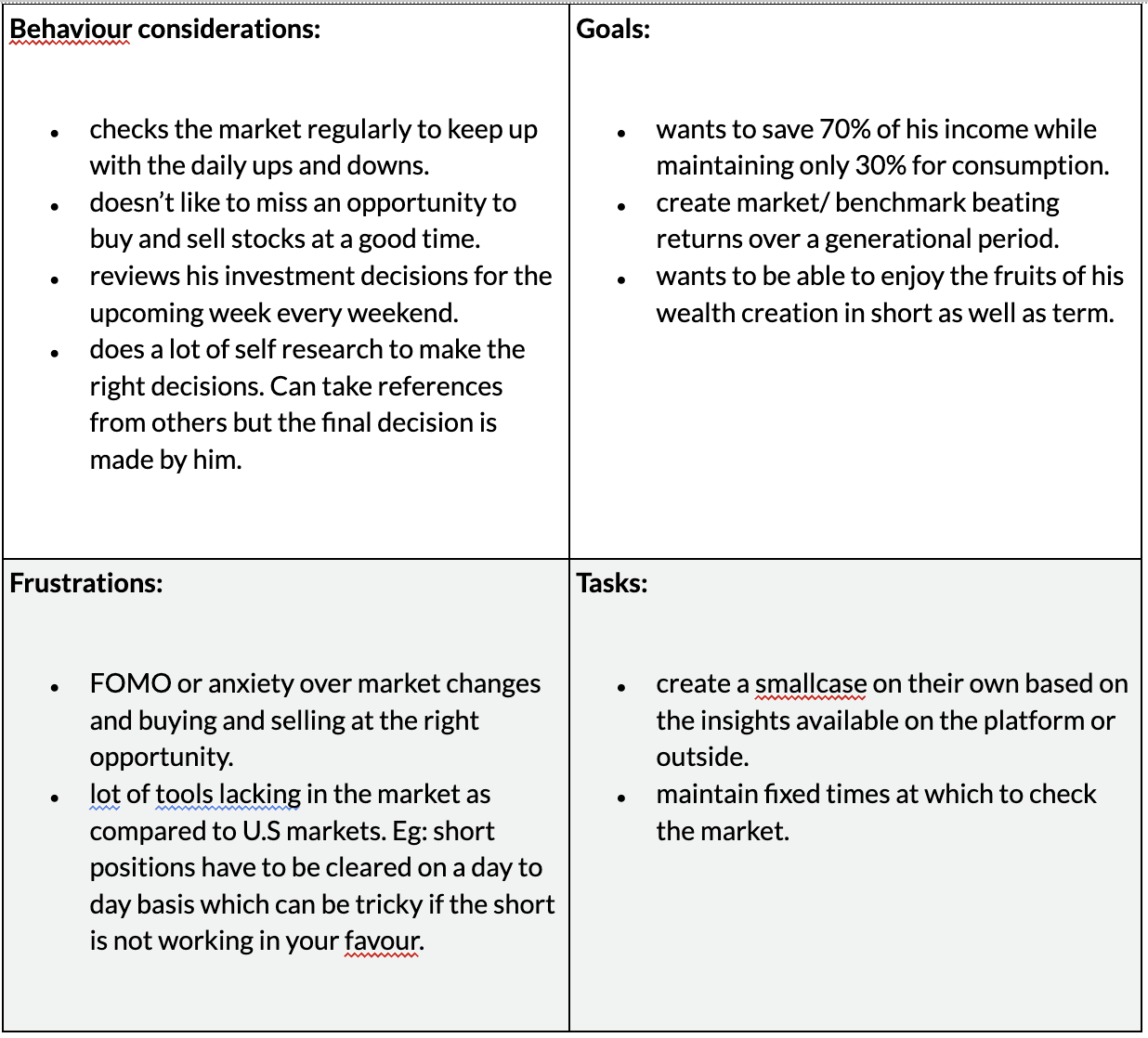

Active Investor: Nihal

Nihal is a 28 year old who runs a family business. He is an active investor who makes independent decisions on his investment activity. He is research-oriented, organised and ambitious in terms of wealth creation.

Keeping in mind the different user personas established, we defined the jobs to be done through our solutions:

Jobs to be done:

As a pre-investor, I want to explore the option of stock investing and finalise on an instrument to get started with. Instrument preferably requiring minimal intervention from me, rather being managed by a professional who will keep me updated on what the next action items from my end are.

As a passive investor, I want to explore direct equity investment, at the same time seek expert guidance and intervention when needed.

As an active investor, I want to be able to make changes to my portfolio investments based on my judgement

Now that we have the user objectives and jobs to be done all laid out, we move to conducting a comparative analysis in order to identify the best practices and the improvements we could make on top of those.

Comparative Analysis:

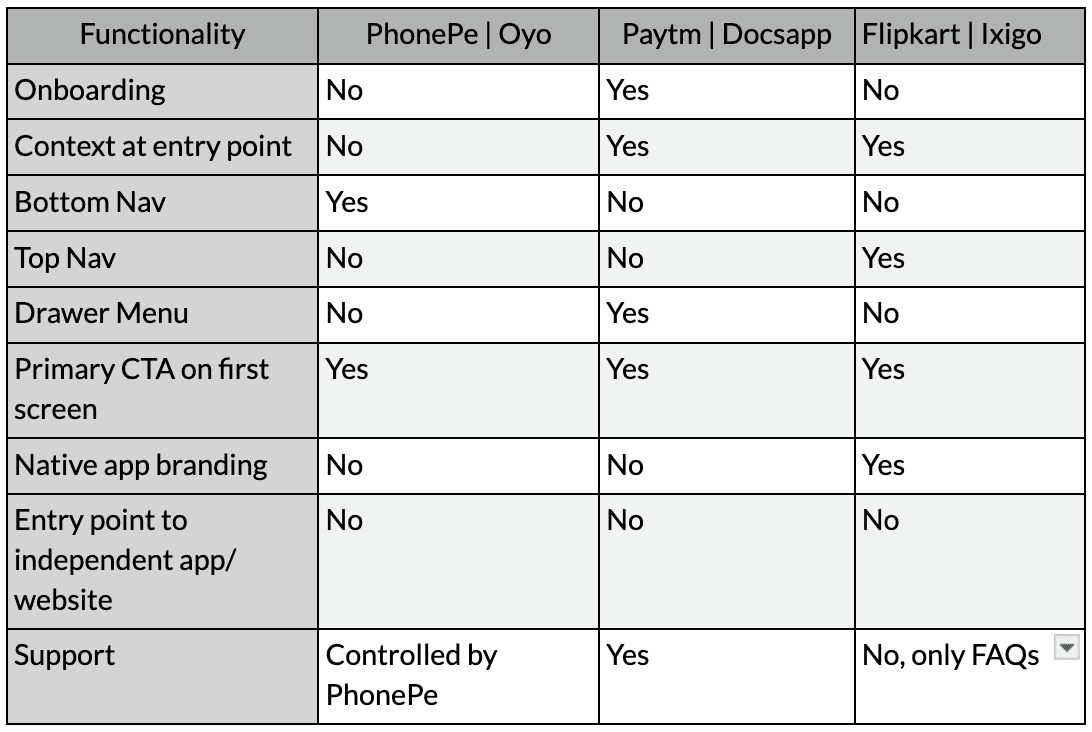

Since there is no direct competitor to the smallcase distribution module, we conducted a comparative analysis of integrated brands on third parties. This was in order to infer context, best practices and mental modal of users set by such integrations available on popular apps. Hence this analysis is more from the UX point of view than the brand offerings.

Some UX questions before I started the comparative analysis were:

How do these integrated brands organise their information architecture - Do they have a landing page to onboard the user to their ecosystem? Do they allow exploration right away? What is the most prominent CTA on the first screen from the entry point on the native app.

How do they navigate between screens in the integrated ecosystem - bottom nav? Top nav? Drawer?

Any native app branding on the integrated ecosystem?

Do they maintain an entry point for the independent app/ website from this integration?

Do they rely on native app’s support or do they have their own support functionality for help related to their ecosystem.

Inferences:

Well known apps with single objective goals do not have an onboarding on the third party app as the brand name is self-explanatory. Eg: Ixigo to book travel tickets. While a new name in the market like Docsapp, needs an onboarding for users to know more about their services.

2 out of 3 do not have bottom nav. From personal experience on all 3 apps, the bottom navigation felt like a clash between partner app bottom navigation and integrated brand bottom navigation.

All 3 apps maintain the primary CTA on the first screen. Even if the first screen is used mostly for onboarding.

2 out of 3 do not have native app branding. Especially ones that are addressed directly by brand name. Ixigo on Flipkart is not addressed directly by brand name but as a Flipkart service namely ‘Travel’, hence retains Flipkart branding.

None of the apps have an entry point to go to the larger independent app/ website. Reason being, it clashes with the interest of the native partner where they would want users to use their app to access the integrated services.

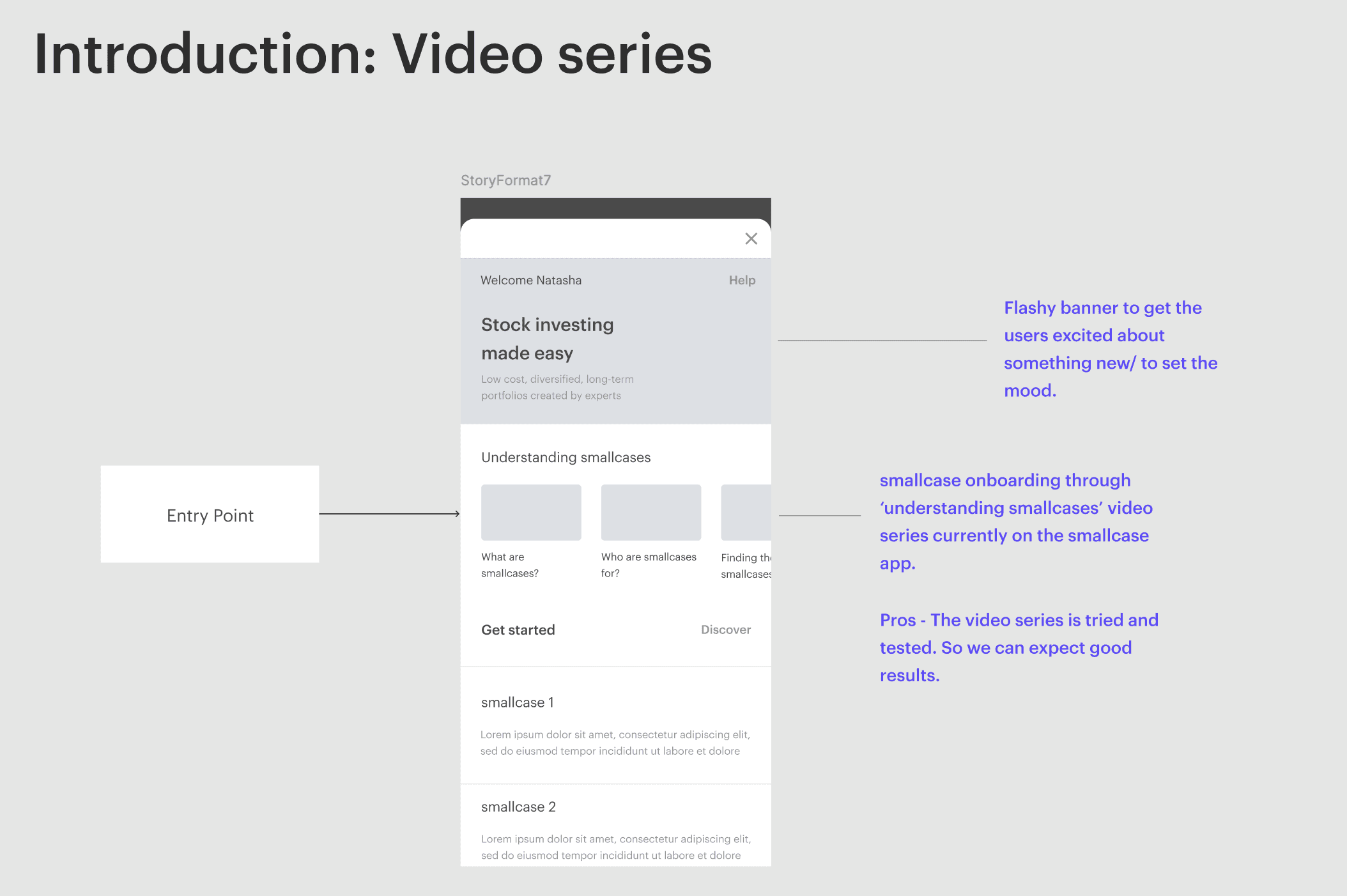

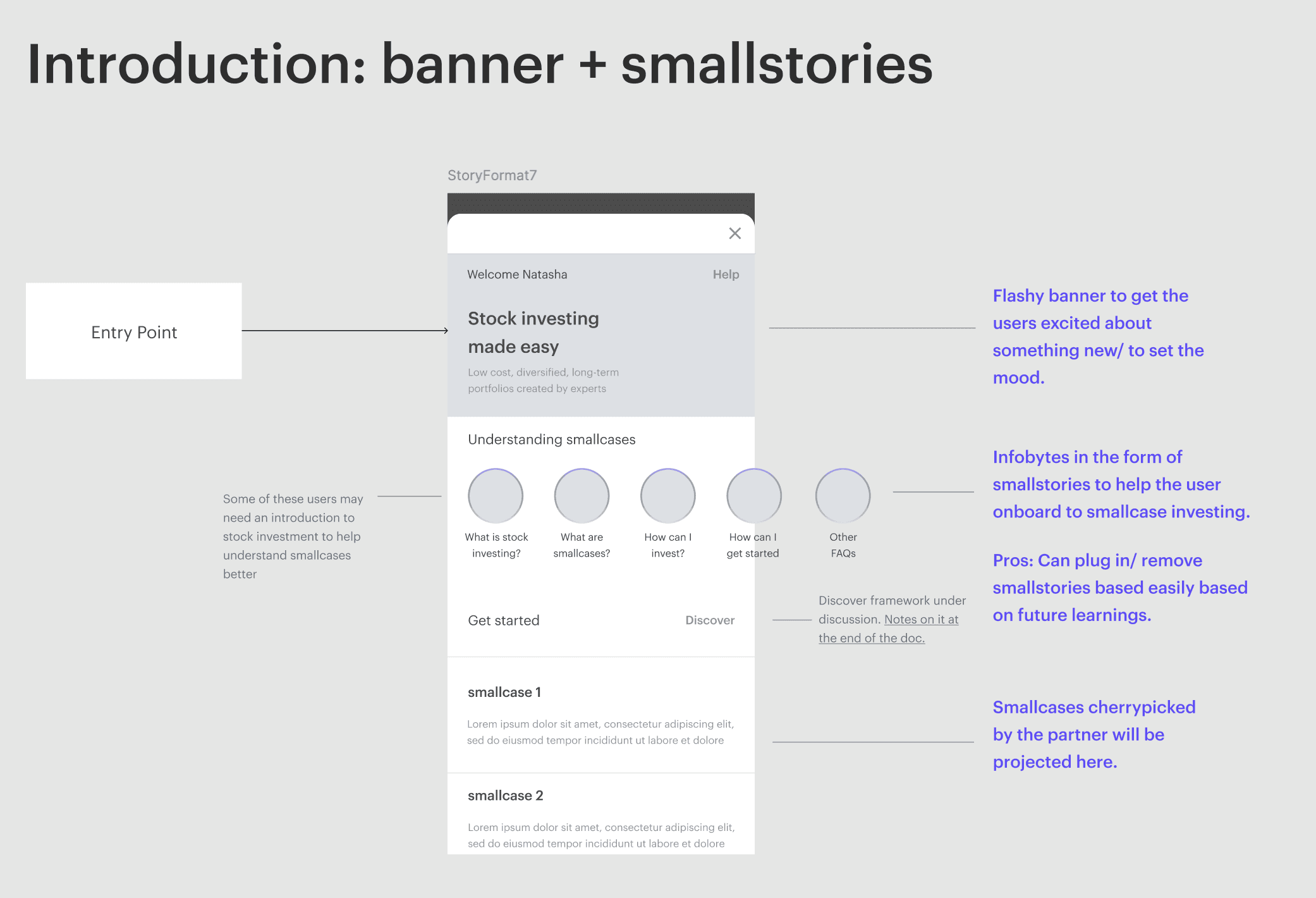

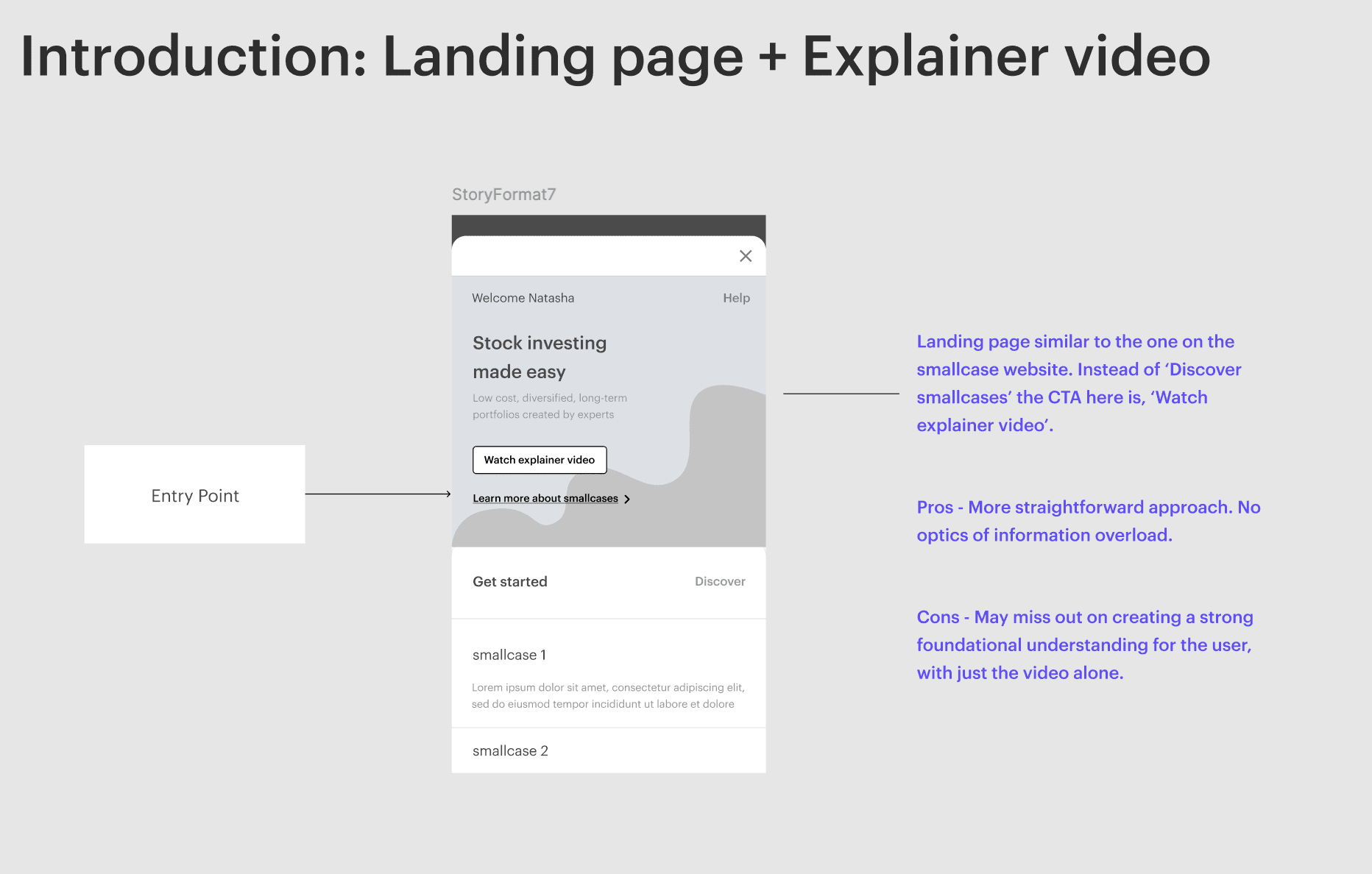

Explorations:

Initial Thoughts:

Discovery module must have enough content educating the user on smallcases to build a strong foundation, especially for the FTUX.

smallcase catalogue should include a list of smallcases cherry-picked by partner, should also be able to provide a generic guide for users to get started with smallcase investing.

Skeletal wireframes

Explore and excute:

Summary notes:

There are two larger usecases identified:

Clients that want less than 10 smallcases. Some may cherrypick smallcases themselves based on renowned managers, well-performing smallcases etc.

Clients with more than 10 smallcases. Can be >25, >60 or all smallcases as on our app.

There are 3 states for the landing screen

Logged Out User (focuses on educating the user)

Logged in User but not invested (focuses on discovery of smallcases)

Logged in user and invested (focuses on investments, encourages growing portfolio)

To create designs only the landing and discover screens for now. The following existing flows from the smallcase app will be plugged in with minor adjustments:

Smallcase Profile

Investment flow

Broker login/ account opening flow

Homepage: Guest User

The home screen for a guest/logged out user serves as a landing page that helps them understand how smallcases work and how they can go about investing in them. It also holds the primary CTA to start discovering smallcases.

Homepage: Logged in User but not invested

Once the user is logged in, but not invested yet, they will see the following on the homescreen:

Overview card giving a quick look at their investment values

Investment insights on selected smallcases they can begin with

‘In the spotlight’ carousel with smallcases that are trending and popular

‘About the manager’ section to induce confidence in the user about the professional experts managing the smallcases

Homepage: Logged in User and invested

Once the user has invested in a smallcase, their homescreen will include the following:

Investments overview section

Pending actions for smallcases that have rebalance, SIP, subscription renewal etc due.

Investment insights

CTA to discover more smallcases to grow their portfolio

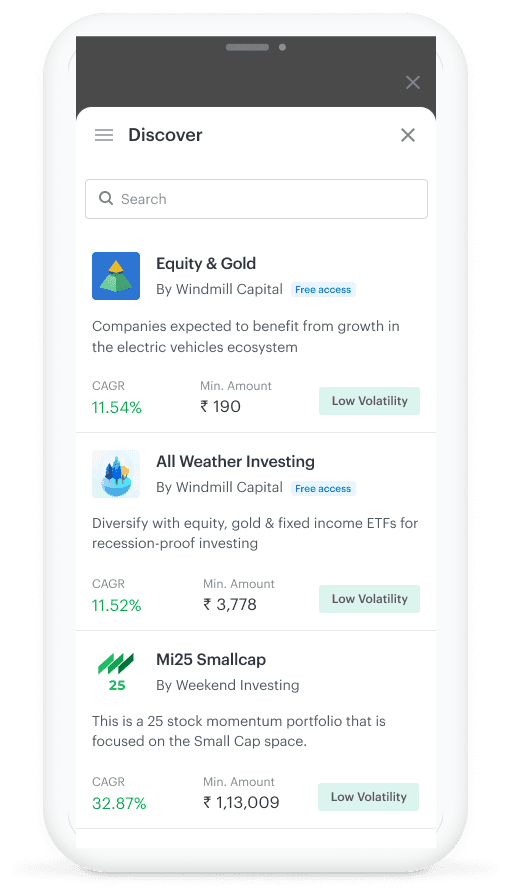

Discover

A dedicated discover screen to help the user explore smallcases by different categories. This screen includes:

‘In the spotlight’ smallcases

Filters like ‘top gainers in the last year’, ‘Low investment amount’, ‘Popular investment strategies’ etc

Smallcase collections

About the managers card which redirects them to the list of managers managing these smallcases.